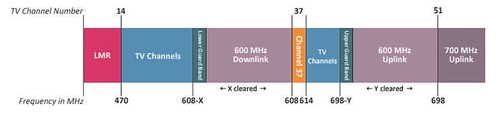

Under the original 600 MHz auction plan, AT&T and Verizon would only have been allowed to bid on 30 MHz if broadcasters were willing to sell 60 MHz or more. As spectrum is usually sold in 10 MHz blocks, AT&T and Verizon would have had to inequitably split the airwaves available to them in each market.

The revised spectrum plan, approved last Thursday, allows AT&T and Verizon to bid on at least 40 MHz regardless of how much spectrum broadcasters are willing to sell. It would also reserve 30 MHz for smaller carriers.

The FCC says AT&T and Verizon command around 70 percent of all low-band spectrum licenses. Sprint and T-Mobile hold around 15 percent of all low-band spectrum licenses.

According to the analysts at New Street Research, AT&T owns an average of around 57 MHz of low-band spectrum in the nation’s top 100 markets, putting it above the 45 MHz threshold for the FCC’s 600 MHz auction. Verizon owns an average of around 47 MHz of low-band spectrum in the nation’s top 100 markets.

The FCC’s spectrum screen previously kicked in if a carrier acquired more than one-third of the covered a total of roughly 453 MHz total (or 150 MHz) in a given market.

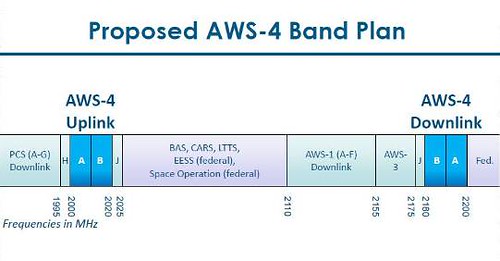

Under the FCC’s new changes, the screen now includes a total of 582 MHz of spectrum (due to the addition of the AWS-4, H-Block, and EBS 2.6 GHz bands).

That means a carrier could acquire more than 195 MHz (around one-third) of the total spectrum in a given market.

Sprint now owns an average of roughly 201 MHz of spectrum in the nation’s top 100 markets, largely due to its vast holdings of 2.5 GHz spectrum. In comparison, Verizon owns an average of 105 MHz, AT&T owns 129 MHz and T-Mobile owns 78 MHz of spectrum in the nation’s top 100 markets.

The FCC may also withdraw its plan to reserve up to 30 MHz of spectrum during the auction for smaller carriers if Sprint and T-Mobile pursue a merger.

“It appears that both AT&T and VZ have a clear path toward acquiring DISH spectrum; neither deal would trigger the screen,” the analysts at New Street Research wrote today in a note to investors.

Meanwhile, Sprint and T-Mobile US stopped short of promising to participate in the 600 MHz auction.

Clearly Sprint needs to sell some 2.6 GHz spectrum and Dish needs an infrastructure partner.

A Sprint/T-Mobile merger or a Sprint/Dish merger at this time would aggravate the 600 MHz spectrum cap. Maybe that’s why AT&T went for DirecTV.

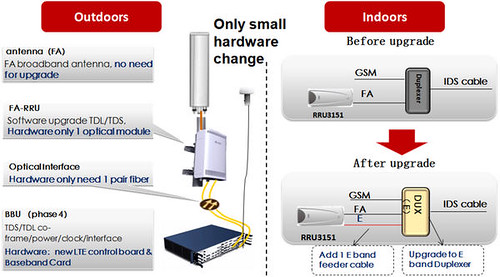

Dish, apparently, could now safely sell 20 MHz of AWS-4 to Verizon without screwing up the spectrum cap on the 600 MHz auction. Perhaps Dish could also form a partnership with Google, using 40 MHz of Sprint’s 2.6GHz. That would allow Sprint to buy much needed 600MHz, improving their indoor coverage and filling in their 2.6 GHz gaps. Sprint and T-Mobile might safely merge — after the 600 MHz auction — with a coverage powerhouse.

Then, for example, a Dish/Google Wireless partnership could emerge and split off, delivering a streaming video/fixed broadband service.

But could rooftop small cells, fed by Google Fiber, deliver a cost/effective solution? It’s a stretch.

China Mobile will be the first to find out.

Posted on Mon, 19 May 2014 14:44:39 +0000 at http://www.dailywireless.org/2014/05/19/...z-auction/

Comments: http://www.dailywireless.org/2014/05/19/.../#comments