AT&T and DIRECTV today announced that they have entered into a definitive agreement to merge in a stock-and-cash transaction for $95 per share. The agreement has been approved unanimously by the Boards of Directors of both companies.

The purchase price implies a total equity value of $48.5 billion and a total transaction value of $67.1 billion, including DIRECTV’s net debt.

AT&T would become the country’s second-biggest pay TV provider, behind only Comcast, which agreed in February to buy Time Warner Cable for $45 billion.

AT&T says it expects to close the acquisition within 12 months. The merger is likely to face scrutiny from government regulators, who have expressed rising concern that the nation’s television and Internet services are increasingly controlled by just a few corporate giants.

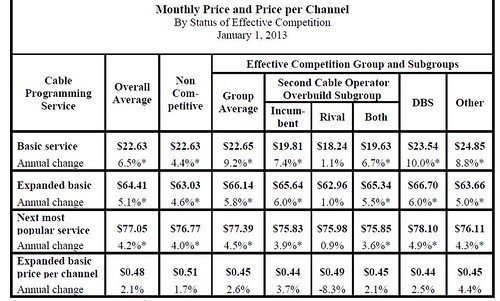

In 2012, U.S. cable-TV bills increased 5.1 percent, to an average of $64 a month, triple the rate of inflation, according to a government report.

DIRECTV, with 20 million subs, has premier content, particularly live sports programming, with exclusive pay TV rights, on TV, laptops and mobile devices.

The transaction enables the combined company to offer bundles of video, broadband and mobile using AT&T’s 2,300 retail stores and thousands of authorized dealers and agents of both companies.

AT&T says it plans to bid at least $9 billion in connection with the 2015 incentive auction provided there is sufficient spectrum available in the auction to provide AT&T a viable path to at least a 2?0 MHz nationwide spectrum footprint.

AT&T says the combined company will position the company to deliver traditional pay TV, on-demand video services like Netflix or Hulu streamed over a broadband connection (mobile or fixed) or any combination.

Posted on Mon, 19 May 2014 12:57:44 +0000 at http://www.dailywireless.org/2014/05/19/...5-billion/

Comments: http://www.dailywireless.org/2014/05/19/.../#comments